Maximize Your Financial Investment: A Thorough Consider the EB-5 Visa Opportunity

The EB-5 Visa program offers an engaging method for international financiers looking for permanent residency in the United States through tactical financial commitments. With varying financial investment thresholds and the possibility for considerable economic impact, this program not just helps with migration but likewise aligns with wider objectives of job creation and area advancement. Maneuvering through the complexities of the application process and understanding the linked threats are crucial for maximizing the benefits of this chance. As we check out these components, essential insights will emerge that can significantly affect your investment approach.

Overview of the EB-5 Visa

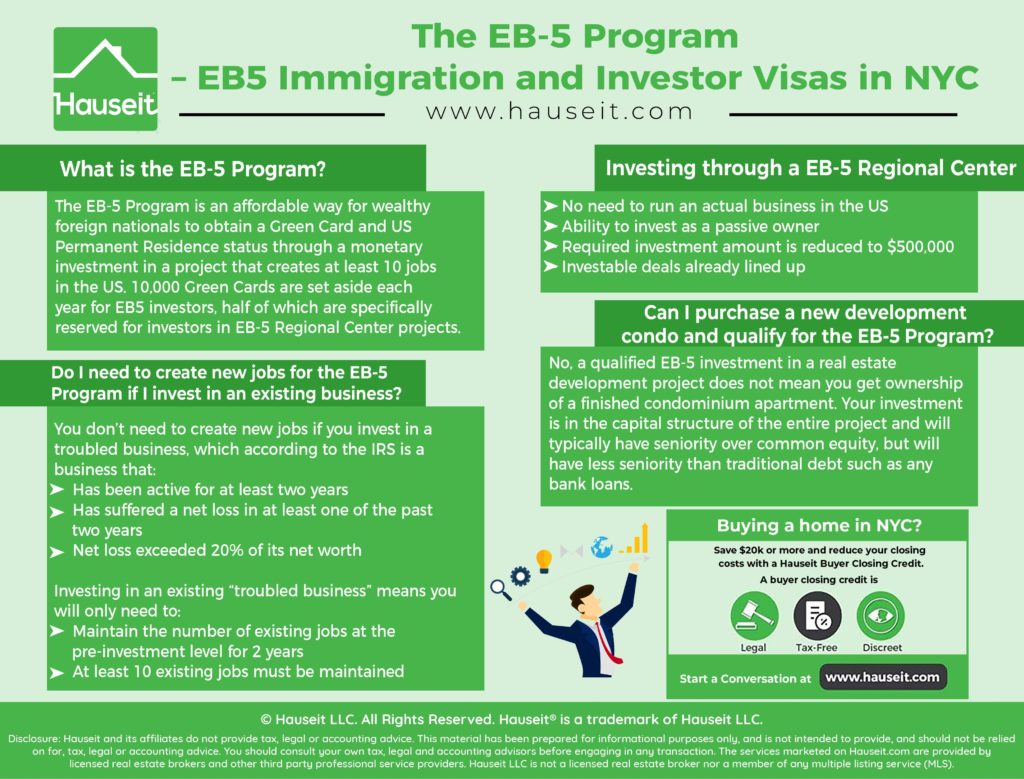

The EB-5 visa program provides an one-of-a-kind pathway for international financiers looking for long-term residency in the USA, allowing them to acquire a visa by buying united state businesses. Developed by the Migration Act of 1990, the program aims to stimulate the united state economic climate with resources investment and work development. It is made for people who can satisfy specific requirements, including the financial investment of a minimum needed quantity in a brand-new business business.

The EB-5 program is significant for its focus on task development; financiers must demonstrate that their investment will maintain or produce at the very least ten full time tasks for U.S. employees. This concentrate on financial advantage straightens with the program's objective of drawing in international funding to improve regional economic situations. Furthermore, the EB-5 visa makes it possible for capitalists and their instant relative to reside in the U.S. while appreciating the advantages of irreversible residency.

Investment Demands and Options

Capitalists curious about the EB-5 visa program need to follow particular financial investment demands that dictate the minimal resources necessary for eligibility. As of 2023, the typical investment quantity is $1 million. If the financial investment is directed towards a Targeted Work Location (TEA)-- specified as a country area or one with high unemployment-- the minimum demand is lowered to $800,000. (EB-5 Visa by Investment)

The EB-5 program supplies 2 primary avenues for financial investment: Direct Investment and Regional Facility Financial Investment. Direct financial investment involves the financier investing or establishing in a new business enterprise that develops a minimum of ten full-time tasks for qualifying U.S. workers. This course might call for a lot more energetic involvement in business operations.

Conversely, Regional Facility investment enables investors to add to pre-approved tasks handled by assigned Regional Centers. This alternative commonly offers an extra passive investment possibility, as the Regional Center takes on the obligation of job creation and conformity with EB-5 regulations.

Advantages of the EB-5 Program

Joining the EB-5 program opens a path to numerous advantages for foreign capitalists seeking U.S. residency. One of the primary advantages is the opportunity for investors and their instant family participants to obtain an U.S. visa, granting them permanent residency. This status allows individuals to live, function, and research anywhere in the USA, offering access to a riches of resources and opportunities.

Individuals in the EB-5 program advantage from the stability and security linked with U.S. residency, consisting of the defense of possessions and the capability to travel openly in and out of the country. On the whole, the EB-5 program provides an unique possibility for international capitalists to obtain residency while adding to the U.S. economic situation, making it an eye-catching option for those seeking new starts.

Job Creation and Economic Effect

The EB-5 visa program plays an essential function in stimulating job creation and cultivating economic growth in the United States. By attracting foreign financial investment, it not only generates new job opportunity however also enhances local economies. Recognizing the program's influence on task markets and economic advancement is very important for possible investors and communities alike.

Job Development Possible

Using the possibility of the EB-5 visa program can significantly add to work development and financial development within targeted locations. The program mandates that each international investor contribute a minimum of $900,000 in a targeted work area (TEA) or $1. EB-5 Investment Amount.8 million in other regions, with the objective of protecting or producing at least ten full time tasks for united state workers. This need not only incentivizes international financial investment however likewise promotes neighborhood economies by producing job opportunity

Projects moneyed via the EB-5 program frequently concentrate on industries that are critical for development, such as actual estate hospitality, growth, and facilities. These campaigns can cause the facility of brand-new services, expansion of existing business, and ultimately, a stronger workforce. In addition, the increase of resources from EB-5 investors allows for the undertaking of massive jobs that would certainly or else be unfeasible, therefore boosting job creation possibility.

In addition to direct employment, the surge effect of job development reaches supplementary services and markets, fostering a robust financial setting. The EB-5 visa program, subsequently, plays a critical function in driving task development and supporting regional neighborhoods, making it a critical investment possibility.

Economic Growth Payments

EB-5 financiers' contributions to economic development expand past simple work production, incorporating a wide array of positive impacts on local and regional economic situations. By spending a minimum of $900,000 in targeted employment areas or $1.8 million in non-targeted locations, these capitalists assist in the establishment and growth of companies, which stimulate community frameworks and services.

The resources increase from EB-5 financial investments typically leads to the growth of new commercial projects, property endeavors, and necessary services. This not just creates straight job opportunity however also stimulates indirect work growth within supporting sectors, such as building and construction, retail, and friendliness. EB-5. Enhanced organization activity boosts tax revenues, providing neighborhood governments with extra sources to money public services and framework renovations.

The broader economic influence of the EB-5 program consists of increased customer spending, improved residential property values, and improved area amenities. Consequently, areas that bring in EB-5 financial investments commonly experience a revitalization of neighborhood economic situations, fostering an atmosphere for lasting development. Ultimately, the EB-5 visa program serves as an effective device for financial development, profiting both capitalists and the neighborhoods in which they spend.

The Application Refine Explained

The application procedure for the EB-5 visa includes a number of vital actions that prospective financiers have to navigate to protect their visa. Understanding the eligibility requirements is crucial, as this structure will direct applicants via each stage of the process. In the adhering to areas, we will lay out these demands and supply an in-depth step-by-step guide to effectively completing the application.

Qualification Demands Review

Maneuvering via the qualification needs for the EB-5 visa can be a complicated procedure, however comprehending the key components is essential for potential capitalists. The EB-5 visa program is designed for international nationals looking for irreversible residency in the USA through financial investment in a brand-new industrial business. To qualify, an applicant has to invest a minimum of $1 million, or $500,000 in targeted employment locations (TEAs), which are specified as country or high-unemployment regions.

In addition, the investor has to show that the investment will develop or maintain at the very least 10 full time jobs for qualifying united state workers within two years. It is likewise critical for the applicant to show that the funds used for financial investment are legitimately gotten, requiring extensive paperwork of the source of funding.

Additionally, the investor has to be proactively included in the organization, although this does not need everyday administration. Compliance with these eligibility demands is necessary, as failing to satisfy any kind of standards can cause the rejection of the visa. Recognizing these components not just aids in preparing a durable application but likewise boosts the chance of effectively maneuvering the EB-5 visa process.

Step-by-Step Refine

Steering through the application procedure for an EB-5 visa needs a systematic approach to ensure all requirements are met efficiently. The very first step entails selecting a suitable investment task, preferably within an assigned Targeted Work Area (TEA) to optimize benefits. After identifying a project, it is necessary to conduct comprehensive due diligence to evaluate its stability and compliance with EB-5 policies.

Next off, applicants should prepare Form I-526, Immigrant Request by Alien Capitalist, outlining the investment's resource of funds and economic impact - EB-5 Visa by Investment. This type is gone along with by supporting paperwork, including evidence of the investment and proof of the job's work development capacity

Upon authorization of Kind I-526, applicants can proceed to make an application for an immigrant visa via consular handling or adjust standing if already in the united state. This entails submitting Kind DS-260, Application for an Immigrant Visa and Alien Registration.

Usual Challenges and Considerations

Steering the EB-5 visa process provides numerous common challenges and considerations that possible investors need to thoroughly examine. One main concern is the substantial financial investment called for, which presently stands at $1.05 million or $800,000 in targeted employment locations. This significant funding dedication requires extensive due persistance to ensure the task is sensible and aligns with the investor's financial objectives.

An additional obstacle is the extensive processing times linked with EB-5 applications, which can extend beyond 2 years. Financiers must be prepared for feasible hold-ups that can impact their migration timelines. In addition, the need to maintain or develop at the very least ten permanent jobs can complicate project choice, as not all ventures ensure task production.

Furthermore, the threat of financial investment loss is a key factor to consider. Investors must look for tasks with a solid track document and transparent monitoring to alleviate this risk. Modifications in migration policies and guidelines can impact the EB-5 program's security, making it vital for investors to remain informed regarding legislative advancements. An extensive understanding of these obstacles will enable possible financiers to make enlightened decisions throughout the EB-5 visa procedure.

Success Stories and Case Researches

The EB-5 visa program has enabled countless financiers to achieve their migration objectives while adding to the U.S. economic climate via job development and capital financial investment. A noteworthy success story is that of a Chinese business owner that invested in a local center concentrated on renewable resource. His financial investment not just protected his household's visas however likewise helped with the development of over 200 jobs in a struggling community, highlighting the program's double benefits.

An additional compelling instance involves a group of financiers that merged sources to create a high-end hotel in a city. This task not only generated substantial employment possibility but additionally revitalized the site web regional tourism field. The financiers effectively obtained their visas and have actually since broadened their company portfolio in the U.S., more demonstrating the possibility for growth through the EB-5 program.

These instances highlight just how tactical financial investments can lead to personal success and wider financial effect. As potential financiers take into consideration the EB-5 visa, these success tales act as a confirmation of the program's possibility to transform neighborhoods and lives alike, urging additional involvement in this important possibility.

Regularly Asked Questions

What Is the Regular Handling Time for an EB-5 Visa?

The common processing time for an EB-5 visa differs, typically ranging from 12 to 24 months. Elements influencing this timeline consist of application volume, private situations, and regional center authorizations, affecting general processing efficiency.

Can My Household Join Me on the EB-5 Visa?

Yes, your family members can join you on the EB-5 visa. Spouses and unmarried youngsters under 21 are qualified for derivative visas, permitting them to acquire irreversible residency along with the key candidate in the EB-5 program.

Are There Certain Industries Preferred for EB-5 Investments?

Yes, certain industries such as realty, friendliness, and infrastructure are typically preferred for EB-5 investments. These markets generally demonstrate solid development possibility, work development capacity, and alignment with united state financial advancement objectives.

What Occurs if My Investment Stops working?

If your financial investment fails, it might endanger your qualification for the EB-5 visa. The U.S. Citizenship and Migration Solutions needs evidence of task creation and funding in danger; failing to fulfill these might lead to application denial.

Can I Live Anywhere in the U.S. With an EB-5 Visa?

Yes, owners of an EB-5 visa can stay anywhere in the United States. This versatility permits capitalists and their households to pick their favored places based upon personal demands, employment possibility, and lifestyle choices.

The EB-5 visa program supplies a distinct path for international capitalists looking for long-term residency in the United States, permitting them to obtain a visa by investing in United state organizations. Financiers interested in the EB-5 visa program have to stick to details investment demands that dictate the minimal capital necessary for qualification. The EB-5 program uses two key opportunities for financial investment: Direct Investment and Regional Facility Financial Investment. Comprehending these financial investment demands and alternatives is essential for potential investors intending to navigate the intricacies of the EB-5 visa program properly. The EB-5 visa program has enabled numerous capitalists to achieve their migration goals while contributing to the U.S. economy via work production and resources financial investment.